- Tips & Tricks

- Jan 20, 2022

Everything You Need To Know For Successfully Bootstrapping Your Startup

“What sets bootstrapping apart from other forms of business funding is that it relies heavily on entrepreneurs’ frugal thinking, creativity, thriftiness, planning and cost-cutting efficiency skills.”–Victor Kwegyir, Lessons For Success.

When most entrepreneurs choose the starry path of getting capital investments from the big fish in the industry, some prefer the path of bootstrapping to start their ventures. Regardless of which category you belong to, you will find this article incredibly insightful, especially if you have no money in hand but have high ambitions.

Starting from what this term actually is, to discuss the pros/cons, tips & tricks, and lastly, the success stories of powerful bootstrappers, we’ll cover everything in this piece of work. Stay with us to get all related information about bootstrapping.

What is Bootstrapping?

A minimalistic approach in which entrepreneurs start their setups from scratch without outside investments. It is a case of ultimate sparseness and can be considered an autonomous procedure that grows extravagantly without external support.

Fundable has reported that many successful companies were started as self-funded enterprises and then succeeded in getting more considerable investments. Github is a name everyone knows, but do you know they also started their journey from bootstrapping?

Those who start their companies independently, without capital investments, are a rare breed. Not every entrepreneur has the guts, patience, and competitiveness required to handle a low investment business. It needs a certain amount of risk, which you must take if you want to touch the sky.

According to traditional thinking, capital investments play a fundamental role in deciding the future of businesses. Despite this, bootstrappers prove that talent and skills are sufficient to build worthwhile startups. We have the example of Steve Jobs, his dedication, determination, and belief in himself were the key factors that made him what he is today.

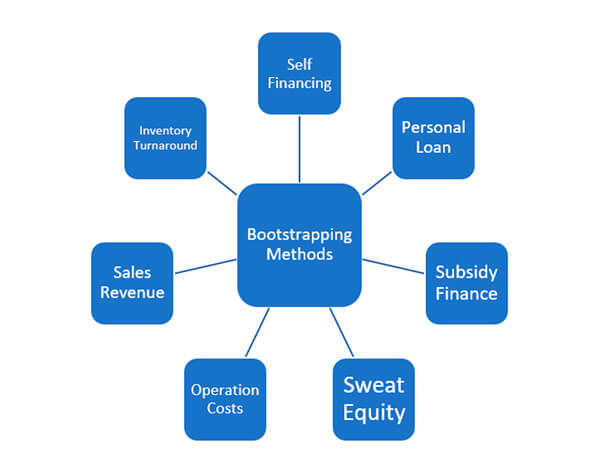

Different Bootstrapping Methods

Bank loans, personal investments, and contributors can maintain bootstrapping startup cash flow, thus helping businesses to get off the ground. Here are some of the financing methods that bootstrappers can use to start a small business:

-

Self-Financing

In this method, the company owners usually invest their savings and income.

-

Sales Revenue

The revenue generated by selling products or services can be used for business development during the beginning phases.

-

Personal Loans

Credit card debts or loans obtained from a third party are viable options to fund the business.

-

Inventory Turnaround Time

Inventory is kept at a minimal level, and a fast turnaround is achieved at the start. It reduces expenses and generates quick profits to reinvest.

-

Sweat Equity

Sometimes, a third party other than investors; contributes a small amount to the company if they see the potential in the business idea.

-

Subsidy Finance

Taxes are kept at the minimum by selecting the proper tax strategies for the businesses.

-

Operating Costs

During the early phase, bootstrappers try to reduce their expenses as much as possible by keeping things simple.

3-Stages to Bootstrap a Business

There are three successive stages to fund a small startup; here’s the detailed information about those stages:

-

Stage 1

At this stage, business owners start the company as a side hustle and spend 3-4 hours/day managing the startup. They put all their resources like income, savings, previous investments, etc., into their dream. This stage is known as the beginning stage.

-

Stage 2

After passing the beginning stage, the businesses start getting orders. The owners save whatever they generate from selling the products. Those savings are used as an investment for the business. This stage is called the customer-funded stage because companies invest whatever they earn.

-

Stage 3

It is the final stage, also known as the credit stage. The time and income are entirely invested in the business to hire a workforce, get better equipment, automate processes, etc. The company starts looking for capital investments and bank loans to step up its game.

How to Bootstrap a Company?

Bootstrapping a company requires tenacity, public speaking, keen observation, cognitive skills, resilience, and courage to deal with rejection. Those who have these characteristics usually manage to make their companies very successful. Here are some things you need to know before starting your startup:

Sell Your Services

Many exceptionally gifted and skilled people come up with unique ideas to execute; however, they lack funding. When this happens, it is better to create a free website, outline the problem, share with prospects and sell your solution manually than to take out loans or give up on your dreams.

In a report by Upwork, the US workforce has contributed nearly $100 million as a freelancer in 2020. So, you can imagine how many people are selling their skills to earn passive or active income.

Creatomic founder Jon Westerberg is an example for those who have skills but have no money to achieve their dreams. He started his voyage by selling his services as a freelancer to earn $3000 per month. It was challenging but not impossible.

He used the cold pitching technique and contacted real estate companies. Jon sent 500 customized emails to the companies; only 63 replied, and eight hired him. Quite surprising, right? But after all the struggle, he could get the $3000 he wanted per month. With his earnings, he started a company and fulfilled his dream of handling his own marketing agency. Impressive! Right!!

From Jon’s journey, we learned that:

- You have to be strong enough to bear the loss without losing hope

- Never leave your dreams without trying for them

- Be smart and steady in your work.

Negotiate with Advisors

If you’re alone or have a cofounder, you indeed have the plan to execute. However, to acquire a significant market share, you should consult an advisor. They are sharp and efficient people who know how to get the job done. But there is an issue, advisors usually ask for a stake in the business, which ultimately dilutes the profit. Therefore, you must negotiate with them to avoid losing your equity.

A simple example is: suppose you started your company with a 100% share but $0 investment. You found a co-owner, and your claim became 50-50. After launching the company, you both succeeded in getting an asset from a contributor who agreed to invest and demanded a 10% share in the company. Now the profit will be divided as 45%-45%-10%. You’ve already lost 55% of the shares at this stage.

After getting an angel investor or large-scale investment, you’ll lose another 20-30% of total profit, and the shares will become 30%-30%-30%-10%. Now your profit margin has decreased from 100% to 30%.

We learn from the example mentioned above that the more investors, the bigger the profit share will be, the less you’ll get. Therefore, negotiate wisely and save more for yourself.

Successful Bootstrapped Startups

Many companies started their journey as a bootstrapped project, and then with their perseverance and vigor, they successfully became one of the largest leading companies. Examples of Facebook and Google are in front of us, how they started their journey, and where they are today.

Everyone knows about Elon Musk, but do we know about the zip2 struggles? Musk, his brother, and a companion founded this company and got success at very early stages, but it wasn’t for a long time, and they collapsed abruptly. Musk, however, never lost hope and eventually succeeded in getting an angel investor who helped the company get back on its foot.

Likewise, successful companies can motivate us with their founders’ struggles and difficulties. Some of these noteworthy companies are:

They all became giants after bearing all these hardships, which led them to success. Their stories are inspiring yet very useful to learn from.

Success Story of a BootStrapped Venture

Woodman Labs, now called GoPro, is a US company that produces high-definition personal cameras. These cameras are for private use to capture personal memories. They are especially very popular among the modern generation who want to capture their daily life with this wearable technology.

The idea was proposed by Nick Woodman, who wanted to record his surfing experience but failed to do so because he wasn’t a professional photographer. He initially gave the idea of a wearable wrist strap with the camera. He tried to make the device himself, but it needed considerable investment and manufacturing skills.

He successfully raised $10k bootstrapped cash by selling his belongings. He worked hard until he developed a camera system that was 35 mm long. That camera has since evolved with the addition of several new features.

Nick was able to pursue his dream and bring his idea into reality. We can learn a lot from these stories, and one thing which will remain inevitable is “ where there is a will, there is a way.”

Tools for Bootstrapped Ventures

While starting your business, try as much as possible to save the maximum amount of money you have. Instead of having a website, you can start your business on social media, or make a YouTube channel to promote your products.

Use background-free images for the products or a unicolored background. You can use an artificial intelligence background remover to save time and money instead of hiring someone who’ll charge you hourly for the service they’ll provide.

You can also use the Facebook marketplace feature to start with. Once you start getting some revenue, move a step forward and build your website by hiring an expert. Bootstrapped startup landing pages play a fundamental role in attracting clients, and background-free, high-quality product images take care of the rest.

Here are some tools which you may like to use for your company:

MindMeister

Help in organizing the ideas in one place. You can build a mind map, add product-related information, and keep track of your thoughts.

Building Model Canvas

With the help of this tool, you can quickly build your business model and manage them as per your requirement.

Upwork

We’ve explained how you can sell your skills to generate initial investment for your company by working part-time. Upwork provides the opportunity to freelancers to get potential clients that can pay them well for their hard work.

CoFoundersLab

A platform that helps you find qualified partners for your startups. You can use filters to find a like-minded collaborator who can manage the business responsibilities.

BNG

You can find unique company name ideas through this Business Name Generator forum which is totally free and easily accessible.

Dropbox

Once you decide to start your own company, data collection, market analysis, investment tracking, and much more start, which is challenging to handle if not organized properly, Dropbox provides unlimited space for managing sheets and data in one place.

Slazzer

We’ve discussed the importance of having background-free images for the products to run a successful business. Slazzer provides the services to remove, change or customize the background within no time.

Trello

We recommend Trello as a project management tool. No matter how big or small your team is, you can add everyone on the board, set deadlines, add documents, and assign work to your team through Trello cards.

Pros and Cons of Bootstrapping Business

Ownership

The founders are the sole owner in bootstrapped businesses unless they collaborate with the cofounders. Even after collaboration, the owners get the most significant profit share, so it’s a win-win situation.

Leadership Qualities

Those who don’t have the patience and courage to accept criticism from their teammates can’t become successful businessmen. As a founder, you have to understand that your teammates can have a different point of view and might not be available 24/7.

Survival Chances

One of the most challenging things in bootstrapped startups is to manage minimum cash flow. Experts recommend keeping expenses to a minimum and creating a budget. It is advisable to take on some side jobs to earn extra money to prevent a crunch.

Exceptional Management Skills

Starting a company with zero investments is not a child’s play that everyone can handle. It needs entrepreneurial skills and perseverance. We’ve seen many startups fail due to their weak managerial skills. The founders were novices, they couldn’t handle the pressure and workload, so they quit. Due to their ineptitude, their team suffered.

Experts’ Advice

“Most people who fail in life didn’t realize how close they were to success when they gave up”. – Thomas Edison

Bootstrapping is a glimmer of hope for all the enthusiastic entrepreneurs who want to accomplish their goals no matter what. Even though it isn’t difficult to start a business with a personal investment, running it successfully without losing hope is.

Comments (0)